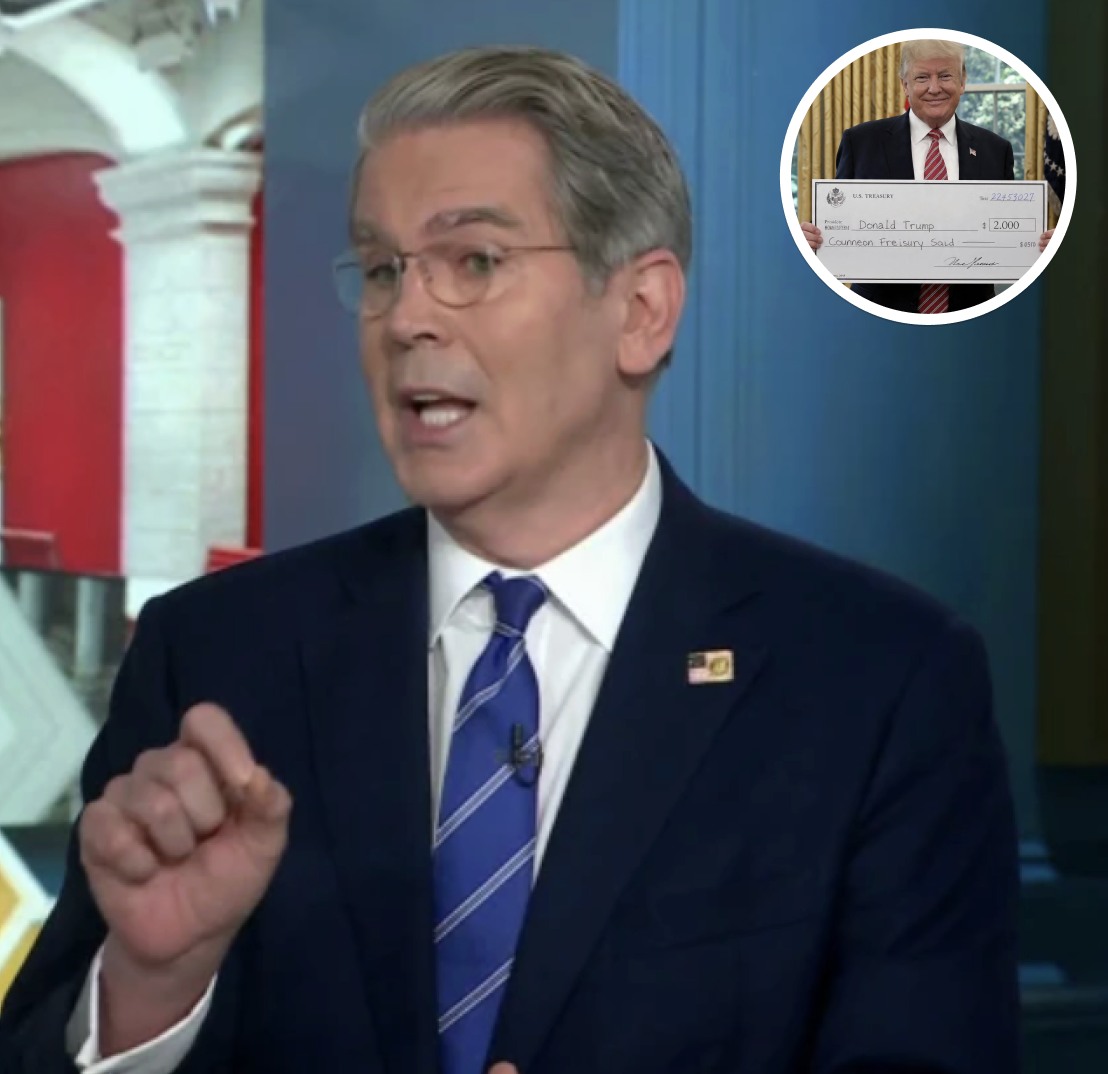

President Trump’s Nov. 9 announcement on Truth Social ignited nationwide debate after he declared that most Americans would receive a $2,000 “dividend” funded by tariff revenue. He argued that strong markets, rising tariff income, and overall economic momentum made the plan realistic. A week later, Treasury Secretary Scott Bessent confirmed the proposal on Fox News, emphasizing that the administration wants the payments directed toward working families. But he stressed that no money can be issued without congressional approval, meaning lawmakers must first define eligibility, decide whether the rebate would be a check, tax credit, or refund, and authorize the spending before anything moves forward.

Concerns quickly emerged regarding cost. The nonpartisan Committee for a Responsible Federal Budget estimated that a stimulus-style payout could reach $600 billion—far more than the roughly $100 billion collected in tariffs through October. At the same time, the Supreme Court is reviewing whether Trump’s tariff structure is constitutional, with justices hearing arguments on Nov. 5. If the Court overturns the policy, the government may owe billions in refunds to businesses and taxpayers, further complicating the financing of any rebate. Still, Trump has promoted the idea aggressively, citing strong 401(k)s, low inflation, and record markets, promising every non–high-income household “at least $2,000.”

Bessent later clarified that the rollout may begin as tax relief rather than physical checks. He suggested exemptions on tips, overtime, Social Security income, and auto-loan deductions as possible first steps. He also previewed new initiatives, including larger tax refunds in early 2026 and a $1,000 “birth investment account” for children born that year. Yet eligibility for the tariff rebate remains undefined, with analysts only able to speculate using CARES-Act benchmarks of $75,000 for individuals and $150,000 for couples.

Congress remains the ultimate gatekeeper. No legislation supporting the $2,000 payment has been introduced, and the DOGE program—once floated as another source of potential savings—has reached only $214 billion of its $2 trillion target. For now, the administration insists the rebate is still on the table, but no timeline exists for when, or if, Americans might actually receive the money.